Villalobos' career has been so long and as they say checkered that it's difficult to know where to begin...or where to end what with Villalobos expanding his scams from California to New York to India.

'Deputy Mayor (Alfred Villalobos) was a Figure in 1991 Texas Bribery Case' http://articles.latimes.com/1993-11-20/news/mn-58842_1_deputy-mayor

Los Angeles Times articles comprising early history of Alfred Villalobos http://articles.latimes.com/keyword/alfred-robles-villalobos

Why isn't it surprising to learn that the money Whittier College Trustee Alfred Villalobos used to get his name on Villalobos Hall at the new Campus Center was taken from public servant health care and retirement funds? Whittier College surely knew the origin of that money and still took it and put Villalobos' name on the new hall. Whittier College students should demand the new hall be renamed, if the College administration and trustees are so morally and ethically bankrupt that they don't do so of their own volition. And what is Alfred Villalobos doing on a college board of trustees? Only at Whittier College.

For a more thorough sense of Alfred Villalobos' life, from losing his position as a Los Angeles Deputy Mayor because of questionable consulting work, "huge gambling debts", bad checks and a consequent bankruptcy filing and lawsuits, to his role in jeopardizing billions of dollars of the retirement funds of public servants across the United States and abroad, see:

'Former CalPERS board member helped steer $1.4 billion to equity firms' by Dale Kasler: http://www.sacbee.com/politics/story/1930326.html

Pension funds scam goes national: Villalobos' New York pension

fund scam http://truenewsfromchangenyc.blogspot.com/2009/05/true-news-updated-all-weekend.html

'Pensiongate Claims Another Resignation, Stephen Moseley/And Will Alfred Villalobos

Be Next?': http://vjmachiavelli.blogspot.com/2009/05/pensiongate-claims-another-resignation.html

More on Villalobos' New York scams http://www.nytimes.com/2009/05/09/nyregion/09ferrer.html?_r=1

New York Attorney General Andrew Cuomo has exposed a "national network" of pension

fund scammers. Indictments are already being handed down. California Attorney

General Jerry Brown is following suit. Alfred Villalobos, it's only a matter

of time before you're held accountable for your role in putting public servants'

hard and honestly earned retirement funds at risk. Yet again, Whittier College

produces and honors a crook. No matter how much money the Villalobos family

and Arvco employees contribute to politicians, taking the hard earned savings

of honest working people, who're trying to send their children to college and

still have an at least modest retirement, and put it at risk is to reveal the

same psychological problem Villalobos has exhibited since he was at Whittier

College: gambling with other people's money. From bouncing a check to a Nevada

casino to cover losses at gaming tables and then filing for bankruptcy, to putting

pension funds at risk for his own lavish lifestyle, heedless of the consequences

for others or himself even as the Pensiongate net's being tightened, presents

us with yet another Whittier College graduate in the Nixon mould.

Villalobos scams goes international

Villalobos' firm Arvco's representatives "bragged" at a conference in New Delhi

that they've "secured more than $16 billion since 1994." Alfred, like Lucy,

you got a lotta splaining to do... Carissa Villalobos (Whittier College,' 99,

and an Athenian Society member) is Arvco's attorney, and she's going to be very,

very busy...

UPDATE: State of California demanding $95 mil from Alfred Villalobos!

The State of California is seeking the return of $70 mil of the monies Alfred Villalobos scammed from public workers pension funds and a $25 mil fine therefore. Before leaving his position as California's Attorney General, Jerry Brown said of the Villalobos and accomplice Buenrostro cases, "This is not the end of this case or the end of this investigation" and "Other things could follow." Brown suggested that there could be more lawsuits and/or criminal indictments from a local D. A., the Fair Political Practices Commission, and/or other law enforcement agencies. New California A. G. Kamala Harris will clearly receive all the support yet again Gov. Jerry Brown can afford as the state moves forward with the Villalbos case.

The State of California successfully sought a freeze on Villalobos assets, which include 16 residences (one of which can be seen on this page), 21 bank accounts, a fleet of luxury vehicles, and artworks, contending, "There exists a substantial danger that Villalobos' assets could be dissipated because of his high-stakes frequent, and uncontrollable gambling." The California Attorney General's offiice claims Villalobos lost $10 mil gambling between 2007 - 2009, and that Villalobos reportedly now owes seven casinos a total of $4.6 mil, and Villalobos claims he needs another $1.1 mil for legal fees.

'Judge refuses to unfreeze Alfred Villalobos assets' by W. J. Hennigan and

Marc Lifsher (L. A. Times, May 29, 2010)

http://articles.latimes.com/2010/may/29/business/la-fi-0529-calpers-villalobos-20100529

Villalobos then filed for bankruptcy (again), which gives him more time to obscure assets and develop a defense against the State of California lawsuit and other possible legal actions against him. It's unlikely that California will win a request for an exemption vis-a-vis the automatic stay halting proceedings against debtors filing under the federal Bankruptcy Code, Chapter 11, especially in the courtroom of a federal judge in Reno, Nevada.

'Villalbos bankruptcy judge is skeptical that state's suit won't get in the way' by Marc Lifsher (L. A. Times, Sept. 10, 2010) http://articles.latimes.com/2010/sep/01/business/la-fi-calpers-villalobos-20100901

'Sacramento Bee' reporter Dale Kaiser, who has written extensively about the

Villalobos and Buenrostro cases, sums up to this point in time in 'CalPERS target

Villalobos files for bankruptcy protection', on June 16, 2010:

http://www.sacbee.com/2010/06/16/2825695/calpers-target-villalobos-files.html?storylink=lingospot

Alfred Villalobos and Pensiongate scandal details emerge as the State of California moves forward with Villalobos case and Villalobos again files for bankruptcy protection:

'CalPERS target Villalobos files for bankruptcy protection' by Dale Kasler

http://www.sacbee.com/2010/06/16/2825695/calpers-target-villalobos-files.html

'Gambling debts send beleagured former CalPERS board member back to Bankruptcy

Court' by Marc Lifsher

http://articles.latimes.com/2010/jun/15/business/la-fi-calpers-villalobos-20100615

(Includes photo of Alfred Villalobos)

'CalPERS scrutinizes a mansion' by Marc Lifsher

http://articles.latimes.com/2009/nov/12/business/fi-calpers

'CalPERS corruption: A plan to make New Yorkers homeless, and $50 M to blowhard

Al Villalobos' by Jill Stewart, The Informer at LAWEEKLY Blogs

http://blogs.laweekly.com/informer/economy/calpers-corrupt-pay-to-play-in/

Links to Alfred Villalobos articles:

http://www.bullfax.com/?9=node/148086

A quick study in private equity tax scams, the gutting of assets, and pension

fund ripoffs:

http://economicwarrior.org/2010/05/08/calpers-corruption-apollo-global-management-the-wall-street-pot-of-gold/

'Harrah's, Apollo Management, and CalPERS/CalSTRS debacle'

http://www.blackjackforumonline.com/w-agora/view.php?site=bjf&bn=bjf_forum&key=1268325580

The Villalobos case has been a long time coming and will take a long time to conclude, but what Alfred Villalbos has been doing has been clear for a long time, there's no way the Whittier College trustees and administration could've been unaware of the source of monies Villalobos contributed to his alma mater, and still that money was accepted, even solicited, and worst of all celebrated. This College's trustees and administration have, yet again, made us all feel dirty, it's time to clean this mess up...

Take Alfred Villalobos' name off our Hall! Remove Alfred Villalobos from our board of Trustees!

UPDATE: Alfred Villalobos removed without comment from Whittier College board of trustees !

Whittier College has removed Alfred Villalobos from the school's Board of Trustees - unannounced, unexplained, during this past summer when students were away from campus and student paper 'Quaker Campus' was on hiatus. The summer seems to be Whittier College's favorite time for potentially controversial or embarrassing actions, like ripping the health, safety, and environment friendly natural grass field out of the stadium and installing health, safety, and environmental hazard artificial turf.

Now, Whittier College, either turn the money accepted from Alfred Villalobos over to the State of California for return to those fleeced by Villalobos and the shady investment firms he conspired with, and rename Villalobos Hall, or rename Villalobos Hall Pensioners Hall - because California's public workers paid for this new hall out of their retirement funds, scammed by infamous Whittier College grad Alfred Villalobos!! What's it all about, Alfie? Payback!!!

Geoffrey C. Shepard Whittier College Trustee Geoffrey C. Shepard (Whittier College, ' 66), 'Mr. [expletive delted]' made himself infamous by helping implement ex-President Richard M. Nixon's disastrous policies and then defending Nixon after the Watergate break-in. Shepard worked day to day with other infamous Watergate criminals like John D. Ehrlichman, Plumbers' head Egil M. 'Bud' Krogh, and G. Gordon Liddy, who was attractive to Nixon for Liddy's obsessive pursuit of Dr. Timothy Leary, whom Nixon called the most dangerous man in America, at Millbrook, Dutchess County, New York. Shepard became Associate Director of Nixon's Domestic Council staff.

See http://www.nixonlibrary.gov/virtuallibrary/documents/exitinterviews/shepard.php to read about some of the policies Geoffrey Shepard was involved in implementing and about some of the criminals he worked with in his own words. Shepard had no qualms about helping create the DEA (Drug Enforcement Administration), even though his ultimate boss - no, not God, not the United States Constitution, not even his own conscience or Law, just - Dick Nixon, had to ignore his own Shafer Commission appointees' conclusion that there is no justification for "a social policy designed to seek out and firmly punish those who use" marijuana. Nixon wanted to make a "goddamned strong statement about marijuana...that just tears the ass out of them." "Them" it turns out has been the tens of millions of overwhelmingly young people whose lives have been deeply damaged by drug-related arrests and incarceration with violent criminals since Nixon began a war on the post-Hiroshima generations.

Nixon began his drug war with Operation Intercept in 1969. See http://en.wikipedia.org/wiki/Operation_Intercept with its 4 external and 3 internal links, and The Consumers Union Report on Licit and Illicit Drugs by Edward M. Brecher and the Editors of Consumer Reports Magazine, 1972, Chapter 59: The 1969 marijuana shortage and "Operation Intercept" at http://www.druglibrary.org/Schaffer/library/studies/cu/CU59.html

The DEA grew out of the fundamentally flawed Operation Intercept mentality, Nixon's notion of a war on drugs, and Geoffrey Shepard was instrumental in carrying out this policy that started Mexico on the road to instability, violence, and now terror, to becoming another Colombia - just what we don't need, and just what Mexicans don't need! - and began the United States on the road to being a major drug producing as well as consuming country, among many unintended consequences.

See 'Once-Secret "Nixon Tapes" show why the U. S. Outlawed Pot: Lumping marijuana, homosexuality, Jews and Commies into one grand conspiracy, a paranoid Richard Nixon launches America's "war on pot" 30 years ago. Here are the tapes to prove it' by Kevin Zeese, March 21, 2002: http://www.alternet.org/story/12666

Whitter College goes to great lengths to avoid having students arrested for marijuana or other illegal drugs - the dropout/transfer rate is already really high, no pun intended - and there's no doubt that Dick Nixon would brand the Whittier College of today as he did so many others as being "soft on marijuana" for its drugs policy. Nixon would certainly demand to know where the drugs Campus Safety confiscates end up, a question Campus Safety Assistant Chief John Lewis repeatedly refuses to answer.

The problem with Whittier College drug policy is that it's dishonest and teaches students dishonesty at the same time that it gives a false impression of how society deals with drug crime, setting students up to be busted once outside Whittier College's sphere of influence. If students shouldn't be penalized for marijuana use, then marijuana should be reclassified, rescheduled, it should be at least decriminalized.

President Herzberger signed and wrote an article for the L. A. Times in support of the Amethyst Initiative, which seeks to insulate schools from liability for consequences of student drinking, which proves deadly to thousands of students every year, by advocating lowering the drinking age, which every scientific investigation without exception concludes is a very bad idea - and not only quite without any scientific merit, but flying in the face of relevant scientific findings - but she can't find a way to advocate for rational marijuana laws, which scientific investigation does support, and no one dies from using marijuana. Welcome to Whittier College, where it's all about liability, not about students' best interests or even their lives.

Somehow it comes as no surprise that Whittier College has benefited by the ill-conceived war on drugs started by Dick Nixon and implemented by henchmen like Geoff Shepard. While natural marijuana has been outlawed, Whittier College alumnus Chester 'Chet' McCloskey (WC, '40) (recently deceased) made so much money through his NORAC chemical company and subsidiary pharmaceutical operation with its monopoly on Marinol, 98% pure synthetic THC, production (prescribed primarily for cancer patients, three of whom have already been killed by Marinol) that he and his wife Olive (WC, ' 44) contributed between $3 - 5 million to Whittier College, including the underwriting of the McCloskey Chair in Chemistry and the Hazel Cooper Jordan Chair in Arts & Humanities endowments.

Chet and Olive (nee Jordan) McCloskey look as though they're no strangers to Marinol: www.whittier.edu/News/Articles/McCloskey.aspx

Chet McCloskey was also one of the three contributors, along with scam artist extraordinaire David D. Mandarich, whose son Christopher was a member of the notorious Poets LAX (Lacrosse) team, no less creepy than Duke's lacrosse team, just better protected from spotlighting and accountability (not just by a boosters club, but by a player father on the school's board of trustees), and Rayburn 'Ray' Dezember (WC, ' 53), a retired San Joaquin Valley banker, making it possible for Whittier College to make the major mistake of replacing the user, game, and environment friendly natural grass Whittier College stadium field with the artificial turf installation that's now a health, safety, and environmental hazard to the entire community.

Indicative of Geoffrey Shepard's disconnect from reality is his book 'The Secret Plot to Make Ted Kennedy President: Inside the Real Watergate Conspiracy'. Shepard's point, according to him, is to show how Democrats took advantage of the Watergate break-in. Duh, Geoff. If Ted Kennedy had been spying on Dick Nixon and breaking into GOP election headquarters, to mention just the tip of a Titanic- or even country-sinking size iceberg of criminal acts, then the GOP would not only have had the right but would, more, have been obligated, to, as Geoffrey sees it (still more proof that one's view of the world is seriously obstructed when one's head is up one's arse), take advantage of that situation or, as the rest of us see it, act to preserve what democracy we have left. Do not hire Geoffrey Shepard as a fireman - because he'd be out there moving smoke around while protecting the fire.

Whittier College Trustees already include an attorney, Ernie Zachary Park, who lacks any sense of the law as having a spirit as well as letter, with his fingerprints all over infamous Whittier College case after infamous case, so Geoffrey Shepard is just redundant. And if Whittier College misguidedly thinks a strange connection to Dick Nixon is a plus for the school, then why not dispense with the embarrassing Shepard and just hold seances to divine Nixon's views?, which would be more accurate than Geoff's guesses. For all Dick Nixon's flaws, he was a leader, not a blind fumbling follower like Geoffrey Shepard. .

David Mandarich

David Mandarich is MDC Holdings' highest paid executive, even though he's titularly second in command.to Larry Mizel. MDC, an interstate operator with numerous subsidiaries, is headquartered in Denver, and has quite a history, and David Mandarich has been in the thick of it. Mandarich's son, Christopher, graduated from Whittier College and played Poets Lacrosse, that refuge from soccer and rugby for upper middle class kids, whose players then bring out the worst in one another, from Whittier to Duke. The Whittier College LAX team has a house and ranks with Whittier's Societies as an epicenter of misconduct. Of course, when the kid is now making an annual salary of $300,000 with a $500,00 bonus, and several thousand company shares thrown in, and while Larry Mizel's wife receives $120,000 for consulting, there's pressure to conform to the way things are, which, unfortunately, is really bad.

MDC builds homes through its Richmond American Homes division, a major builder, but that's not all MDC engages in. The only way for a company like MDC to double its value in a single year is to increase the value of its assets. Since the Reagan administration ended effective regulation of banking and business in general, we've been hit by a relentless series of scams that finally threaten not to rob one grandmother or another of a decent retirement but to impoverish us all. MDC has taken full advantage of deregulation, and the substantial contributions, most critics call them bribes, to politicians, including prosecutors and judges, that are made by the MDC group make denial of MDC wrongdoing unbelievable.

MDC increased the value of its assets, dramatically in the span of a single year, in part by transferring properties, each time increasing their value on paper, which also made bad loans look good on paper, and these transfers involved the use of illegal phony buyers. Developers taking over Savings & Loans and milking them through inflated values and bad loans, is now referred to as the Savings & Loan Scandal, which disappeared hundreds of billions of dollars that had been that of investors, many retirees, and taxpayers through federal deposit insurance pay outs. Operating largely without constraint in the deregulated economy, bankers felt they could also act without restraint since most consequences for their failures or scams were insured by federal deposit insurance. After deregulation set the stage for junk bonds and money market funds to take the profit out of traditional banking, the game would change, but let's take this one step at a time...

'Neil Bush Tied To Firm That Had Ride In Land Scheme Thrifts. The President's Son Reportedly Was A Director Of A Silverado Savings Unit That Acted As A Phony Buyer Of Lots To Aid A Denver Developer http://articles.latimes.com/1990-11-26/business/fi-4022_1_silverado-savings

The anecdotes from the Savings & Loan scandal period are interesting. For example, many people have bashed the Bush family for their lack of business acumen, most often citing George W. Bush's string of failures, but this is just what the Bush family would have you believe. When Neil Bush was borrowing money from Silverado Savings & Loan to drill for oil in an unlikely location, it was less a lack of business acumen and more a lack of ethics. The amount of money received by Bush from Silverado was considerable, millions of dollars, and, when you're not repaying a loan you get that money for free - and in the Neil Bush case without the complication of a messy business to run - this is what has been passing for acceptable business practice, and we wonder why we're in an economic crisis?!

How MDC land transfers created false value increases Junk Bond Daisy Chain Frauds, Michael Milken, and MDC http://www.nancyredstar.com/newslinks/junkbond.htm

Junk bonds, together with money market funds, taking the profit out of traditional banking in the freshly deregulated 80s, compelled banks into a pronounced REPO (Renew and Sale Repurchase) emphasis. The $1.2 trillion subprime market wasn't by itself big enough to cause the more recent bank panic; that required the unregulated, uninsured $20 trillion REPO business to fail through panic-driven collateral calls and so collateral fire sales at discounted prices ('haircuts') that have left banks undercapitalized as trillions of dollars of bank capital have 'disappeared', along with the mutual trust on which banking depends.

With neither backup nor trust, banks can't make loans and so no economic growth is possible. This, explains Yale Econ Prof Gary Gorton, bodes ill for any recovery, let alone renewed growth.

David Mandarich, MDC, real estate deals violate federal Securities law, SEC acts http://www.nytimes.com/1990/11/27/business/report-links-neil-bush-to-securities-law-case.html

MDC was deeply involved with Silverado Savings & Loan, also based in Denver, whose ultimate failure cost investors and taxpayers a still undetermined amount in losses, most conservatively 2 billion but most likely tens of billions all told. But even the closing of S & Ls like Silverado and Lincoln Savings & Loan didn't stop these incorrigible scammers, as Rodney Stitch notes in his book, 'DEFRAUDING AMERICA':

"The fraud by the Denver group inflicted billions of dollars in direct losses upon the American people. But it didn't end there. The same Denver group and others who brought about the collapse of the savings and loan industry by their corrupt activities, used their Washington influence to buy back properties and other assets from the Resolution Trust Corporation at ten and twenty cents on the dollar. They made money bringing down the savings and loans and made money buying the assets back.

"MDC bought from the RTC $750 million in loans that they had obtained from Silverado for $150, making a $600 million profit, and defrauding Silverado out of $600 million." This wasn't without agreement between the two then three intertwined entities, indeed this had been the ultimate objective of the agreeing parties. Lincoln Savings & Loan and the Keating Five (5 U. S. Senators were found out accepting 'contributions' and blocking action to investigate S & Ls being plumped up to be drained dry by those contributors) received more media attention than did Silverado Savings & Loan, but Silverado was also a classic demonstration of deregulation and corruption. Indeed, the Silverado case is the more frightening because of the highest level of protection the Silverado principals received.

As for MDC housing product, it's clearly oriented to builder profit without too much concern for consumers, who see themselves as home buyers, which is bound to put the two at odds:

MDC's Richmond Homes has settled...class action lawsuit over expansive soils...covering nearly every home it has built since 1986. Repair bill for...12,300 homes covered could run into tens of millions of dollars. Story by Shelly Gonzales for the Rocky Mountain News: http://www.vsss.com/CM/Custom/Custom26.asp

Still, inevitably we would prefer to think, the odds catch up with the crook. But we learn, each at our own pace, that the crook being caught up with is just the beginning of a new series of contests...

Rodney Stitch explains that, "David Mandarich was indicted for illegal contributions, of which Michael Norton, U. S. Attorney General in Denver, was the major recipient." (whittiergate Note: David Mandarich's son Christopher is already a donor to the California Bar Foundation, a favorite charity of the California legal community.) Since Norton had received the money, Stitch continues, "he had to stand aside and have Marvin Collins, U. S. Attorney from Texas, act as a special prosecutor (directed by Norton) to prosecute the case. Mandarich took the fall for the many other big names (whittiergate Note: Big names including Neil Bush...), but was protected by U. S. Attorney Collins, who deliberately presented a weak case to the jury."

The original Judge in this case, the Hon. Richard P. Matsch, had a reputation as a no-nonsense judge who made sure defendants got a fair trial and otherwise conducted himself in a scupulously ethical manner. It has been reported that Judge Matsch's hero is Atticus Finch, who fails to clear his African-American client of a charge of raping a White woman in Harper Lee's To Kill A Mocking Bird, but who truly does all he can and who is his community's conscience.

Atticus Finch couldn't have been more influential if he had been real: http://en.wikipedia.org/wiki/Atticus_Finch

Matsch sentenced the two murderers of Jewish Denver radio talk show host Alan Berg to 192 and 252 years in prison, respectively, and noted that they were not fit to be in society, and also allowed the Ku Klux Klan to assemble in public on Martin Luther King Day, reminding us that all speech is equal under the First Amendment.

Alan Berg Life and Death Recap: http://en.wikipedia.org/wiki/Alan_Berg

Regarding the case at hand...

According to Al Martin and Stew Webb - Webb is the ex-son-in-law of Leonard Yale Millman, the only man above Larry Mizel and David Mandarich on the MDC pyramid - Judge Matsch (later to try the Oklahoma City Murrah federal building bombing case) was assigned to the Mandarich money laundering through illegal contributions case, and that this jurist "made a statement in open court that he was tired of the prosecution bringing in low level vice-presidents" and that "because of the serious evidence he expected the prosecutors to vigorously prosecute those at the top, David Mandarich and Larry Mizel, and that he would vigorously sentence those involved. Within days, his daughter was dead."

Martin and Webb go on to detail how the MDC case was reassigned, how a $1.5 million fine for making illegal campaign contributions, dismissal of the charge against Mandarich and the clearing of Mizel, were arrived at, how a plea bargain was struck. The bargain, it goes without saying, blocks inquiry as to the source of the monies laundered through those illegal contributions.

Elizabeth Ann 'Betsy' Matsch's death has been described as freaky and bizarre. Her death was also without a witness other than John Schnorr, whom those who believe Betsy Matsch was murdered say did the deed. These same critics say Betsy Matsch's murder was an offer her father couldn't refuse, and claim that Schnorr had only come into Betsy's life as the MDC trial began. Schnorr's story is that he and Betsy Matsch were sulfur bathing around midnight when they were sucked into a lava hot-hole. Schnoor said he managed to climb up ten feet of crevice wall, but that Matsch fell down into a steaming chamber 20 feet below the surface. "It took us quite a while to get her out. We couldn't get within 10 feet of her because of the scalding heat." - Hawaii Volcanoes National Park Chief Ranger Jim Martin. Schnorr wasn't even hospitalized.

Betsy Matsch was cooked to death like a lobster, and was likely just as conscious. If she was murdered, like the screams of a lobster being boiled in a pot, Elizabeth Ann Matsch's pleas went coldly unheeded. It's said that Judge Matsch wore a bracelet of his daughter Betsy's when he returned to the court, and that he was no longer the same man.

Colo. Woman Dies; Seattle Man Escapes - Feb. 26, 1992 http://community.seattletimes.nwsource.com/archive/?date=19920226&slug=1477840

http://articles.latimes.com/1992-02-26/news/mn-2725_1_steam-vents-volcano

TIME Magazine's Patrick E. Cole called Betsy Matsch's death a "freak accident". Stew Webb calls what he says is Ms. Matsch's murder "bizarre".

Washington Post article by Lois Romano - May 12, 1997 (Page B01) http://www.washingtonpost.com/wp-srv/national/longterm/oklahoma/stories/judge.htm

David Mandarich's brother, Gary Mandarich, and other lower level MDC execs did plead guilty, Gary to campaign money laundering. Whittier College Trustees without the clout or ruthlessness of David Mandarich would do well to think twice before following him down any shady lane...

From Westword by Michelle Johnston: http://www.westword.com/1995-10-11/news/mr-clean/

Recent reports of David Mandarich's activities make clear that he has not changed his modus operandi:

'Home Builders' Stock Sales: Diversifying or Bailing Out?' asks Julie Cresswell in the New York Times Business section - Oct. 4, 2005

MDC insider stock sales increased from $48 million for all of 2004 to $71 million for the first three quarters of 2005. When questioned, MDC spokespersons denied any loss of confidence in the home building industry.

The Top 100 Selling Insiders At Home Building Companies Through 2005: David Mandarich ranked 4th, selling 285,499 shares of M.D.C. Holdings (MDC Ticker) stock with a market value of $24,943,429.

Building a fortune: Mizel, Mandarich get $40 million-plus as MDC soars http://www.newhomebhildersnewsblog.com/2006/04/building_a_fort.html

MDC execs near top among builders: Mizel, Mandarich richly rewarded as stock tumbles http://www.newhomebuildersnewsblog.com/2006/10/mdc_execs_near_.html

When the question is what is my risk for harming others so that I can prosper, instead of how many people can I help so that I can prosper, then, whether or not I am found guilty of a crime, I am a crook, one of the bad guys. We are making no mistake in seeing Whittier College Trustee David D. Mandarich as a bad guy whose past will surely catch up with him.

(whittiergate Note to CIA and Rogue CIA Operatives: We are aware of military intelligence and other government agencies checking out whittiergate.com content. We are also aware of reported CIA or rogue CIA involvement in Silverado Savings & Loan and other businesses in the United States as well as abroad, and in the Mandarich money laundering through illegal campaign contributions case (shades of Howard Hughes 'contributions' to Dick Nixon and 'loans' to his family members that spurred Nixon to his Watergate blunder).

Through this Note we're making clear our disinterest in CIA or rogue CIA operations foreign or domestic. Our concerns are those of the victims of Whittier College, our sole interest is facilitating restoration of those victims whole and in personnel and policy changes at Whittier College appropriate to a private liberal arts college known for academic integrity and honest dealing, not in any larger matter(s). Some whittiergate activists have intelligence community connections and family histories. Let's remain mutually disinterested.

David Mandarich can act to cause a positive resolution of the issues whittiergate addresses any time he decides to do so, and that in our view is indeed overdue. whittiergate exists solely because of the rotten job David Mandarich and his fellow Trustees of Whittier College have been doing. Since you're in the intelligence business we're sure you'll agree that suggesting to David Mandarich that he carry out his Whittier College Trustee responsibilities properly for a change is the simplest way to make whittiergate unnecessary.)

Fred Anderson, Whittier College's preferred

best-known alumnus since the Watergate scandal, has had to resign from the Apple,

Inc. Board, which he joined after retiring as Apple's CFO, and agree to pay

a $150,000 fine to the SEC for false financial filings and inadequate controls

while Apple's CFO. Anderson, who made more than $10 million from sales of backdated

options, also has to pay $3.5 million, the difference between the profit Anderson

took and the profit he'd have made based on actual option dates, plus interest.

New Apple Board member Al Gore headed an internal probe of that corporation's

options practices as the options backdating scandal brewed, and shared findings

with the SEC and federal prosecutors. While Anderson's agreement with the Securities

& Exchange Commission does not restrict Anderson's activities, his long

relationship with Apple, Inc. is over, and Anderson's reputation is appropriately

permanently tarnished.

There is much speculation that the SEC's lenient treatment of Anderson indicates

that he is now available as a witness in the continuing probes of the Apple

options scandal. Anderson has already blamed Apple head Steve Jobs for the backdating

of Apple options, which claim has brought a terse rebuke from the Apple Board.

The bottom line is that Fred Anderson knew that what he was doing was wrong,

and his projection of responsibility for his wrongdoing shows a clear lack of

remorse. A dirty trick is a dirty trick is a dirty trick, no matter who does

or doesn't opine that a dirty trick is ok, and individuals conducting their

careers ethically know better than to act unethically or illegally.

Anderson is being cast as Apple's 'Fredo' in blogs complete with the appropriate

Godfather clip. Meanwhile, the U. S. Attorney General's investigation of the

Apple options scandal continues...

Search Fred Anderson at www.bloomberg.com

to see 'Ex-Apple Finance Chief to Settle SEC Options Probe' and other articles

on Fred Anderson and the Apple options backdating scandal.

"I Know It Was You, Fredo. You Broke My Heart. You Broke My Heart!"

Fred Anderson: http://digitaldaily.allthingsd.com/20070424/it-was-you-fred-anderson/

Lenient treatment now in exchange for testimony later?

http://infoworld.com/article/07/04/24/HNapplecfodeal_1.html

and

http://valleywag.com/tech/breaking/fred-anderson-flips-254877.php

More discussion of Fred Anderson options scandal settlement: http://valleywag.com/tech/fred-anderson/

Sam Gary Cordova

Sam Gary Cordova, son of a Whittier florist, was graduated by Whittier College and later joined the United States Marine Corps, becoming a fighter pilot.

In action over the Laotian - Vietnamese border on August 26, 1972, Major Cordova, in a F4J, became the only USMC jet pilot to be shot down by an enemy aircraft during the so-called Vietnam War - by a Vietnamese pilot, Nguyen Duc Soat, in a MIG-21.

Major Cordova's remains were finally returned from southeast Asia on December 15th, 1988. RIP.

Sam Gary Cordova bio: http://www.pownetwork.org/bios/c/c157.htm

Nancy Ling Perry

Coming soon...

From cheerleader, Sunday school teacher, and volunteer for Barry Goldwater's campaign to Whittier College to topless blackjack dealer to being shot down by the LAPD trying to flee out the back door of a South Central Symbionese Liberation Army so-called safe house.

Henry Richard Gray went to Whittier College

to play ball, but started drinking heavily and using drugs at the College and

ended up working at a post office, even though Whittier graduated Gray with

a bachelor degree in political science. Gray's family has clearly been dysfunctional,

his mother's record includes a felony conviction, and his sister has been on

parole for a felony drug conviction in Texas. In 1979, six years after being

graduated by Whittier College, Gray, then beyond the College's sphere of influence,

finally went too far: After blackening his wife's eye and taking car keys from

Jacqueline Gray at her workplace, Henry Gray went home, to Hawthorne.

Meanwhile, Ronnie Waddell, with whom Jacqueline Gray was then staying, saw Jacqueline's

battered face and insisted that the car keys be retrieved as well as stating

that Henry Gray should be taught a lesson. Waddell and his ex-wife, Jacqueline

Gray, then called Henry Gray to advise him that they were coming to the Gray

residence to retrieve the car keys.

Henry Gray met his wife and Ronnie Waddell outside the Grays' home, where the

keys were returned, and where Waddell restated that Henry Gray should be taught

a lesson. Waddell took a step toward Henry Gray, and Gray pulled out a concealed

handgun. Waddell responded by saying he wasn't afraid of Gray's "little

gun", and Gray then shot the unarmed Waddell, in the face, fatally. In

1980, Gray was consequently convicted of second degree murder and sentenced

to 15 years to life.

Both Gray Davis and Arnold Schwarzenegger subsequently reversed parole board

recommendations to parole Henry Richard Gray. On the occasion of Gov. Schwarzenegger's

second reversal of a parole board recommendation to release Henry Richard Gray,

the convict went to the courts for relief. The California Court of Appeal, Second

Appellate District, Division Three, has recently ruled favorably on Gray's petition

for a writ of habeas corpus, and he will be paroled from prison after serving

27 years for the murder he committed.

The Court of Appeal panel is certainly a more objective finder of fact than

are politically-motivated politicians. As the Appellate panel reminds, "[P]arole

is the rule, rather than the exception, and conviction for second degree murder

does not automatically render one unsuitable..." (Gray was 27 when he was

sent to prison; he is now 54 years old.) Henry Richard Gray was a bully, and

he was so afraid of being taught a lesson for being a bully that he shot the

man who appeared to him to be about to teach him that lesson.

It took eleven years in prison before Gray stopped using drugs (some commentary

on penal system corruption as well as the difficulty of ending, even under the

greatest duress, habits so casually acquired when one's young on a college campus),

and then stopped doing things like making false filings with the IRS (some commentary

on the ethics Gray picked up in college), and eventually began earning positive

evaluations by Corrections psychologists and parole boards, finally evidently

remade himself - suitable for parole. Let's wish Henry Richard Gray success

in adjusting to reality outside a prison setting, that after all is our best

protection, and pray for Ronnie Waddell, a man who evidently gave his life for

the belief that we need to confront bullies. Waddell unfortunately didn't know

that Whittier College bullies are sometimes shooters, and that lack of information

cost Ronnie Waddell his life.

Henry Richard Gray Petition for Writ of Habeas Corpus:

http://www.lexisnexis.com/clients/CACourts/

Check Terms and Conditions, Click on View Options

Check CA Published Cases, Combined, enter Henry Richard Gray B197193, Click Go

This website has been sent photos of Whittier College students 'playing' with handguns, one of those students a friend of Nicola Jagessar. We urge everyone, especially those associated with Whittier College, to take note that weapons and shootings are part of the Whittier reality.

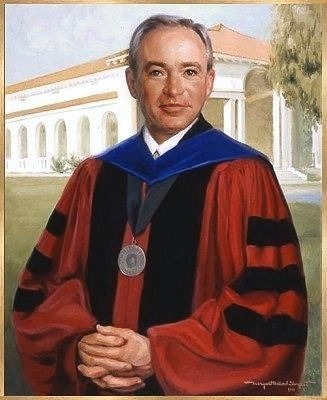

James Lee Ash, Jr.

James Lee Ash, Jr. was Whittier College President from 1989 - 1999. As soon

as Ash left the can do no wrong if you're a member Whittier College sphere of

influence, he ran afoul of the law, repeatedly... This is how Whittier College

sets you up for the hardest falls once you've gone out into the real world...

In northern Nevada it seems, law enforcement protects people, enforces laws.

Nevada courts not only sentenced James Lee Ash, Jr. for repeated drug law and

probation violations, but also made a no contact order barring Ash from any

further contact with Travis Jay Lewis, 18, and an extraordinary stay away order

barring Ash from contact with any and all males under the age of 21.

The Ash cases make the former New Life Church founder Rev. Ted Haggard and Rep.

Mark Foley and other offenders in the Washington Pages Scandals look like the

proverbial lesser evils.

When arrested the first time in Nevada, Ash lied to the police, first claiming

to be an uncle, then mentor, and then counselor, on the basis of Ash's ordination

as a Presbyterian minister, which had lapsed and will not be renewed, of one

of the two 18 year old boys involved in Ash's first Nevada arrest, and about

the methamphetamine, paraphernalia, and marijuana at the scene. The police report

of that first Ash arrest in Nevada noted a "weird uncle relationship."

Ash and Lewis were using a resort room registered in both their names, and a

Sierra Nevada College vehicle. Ash had to resign as President of Sierra Nevada,

like Whittier, a small liberal arts college. Ash was later arrested in relation

to a disturbance with a "roommate" at a Nevada apartment complex,

as well as for subsequent drug and probation violations.

Ted Haggard said of what newspapers called the Reverend's "drug fueled

trysts" with the male prostitute who outed Haggard, "There's a part

of my life so repulsive and dark that I have been warring against it all my

adult life." That is to say, Haggard, like Ash, has been exhibiting enduring

character traits, not sudden interests. What was James Ash, Jr. doing at Whittier

College, for a decade?

Ash's repeated blatant criminal behaviors suggest his time at Whittier College,

which he had left just prior to his Nevada debacle, misled him to believe that

he could indeed do literally any things he felt like doing and get away with

it. Victims in Ash's wake in Whittier? Ash enabled to victimize more youths,

in Nevada - because he wasn't held to account for acting out in California?

Search James Ash at: http://www.tahoebonanza.com/section/NEWS

Rev. Ted Haggard scandal: http://www.msnbc.msn.com/id/15536263/

Rep. Mark Foley & Co./ Congressional Pages Scandal: http://en.wikipedia.org/wiki/Mark_Foley_scandal

When James L. Ash, Jr. left Whittier College and took over at Sierra Nevada

College, SNC's enrollment was nearing the 600 student viability level it had

been striving for since the 1960's. SNC is now going belly up, unable to retain

more than 185 or attract more than 85 new students. According to a SNC spokesman,

James Ash's misconduct and crimes "certainly didn't help us." http://www.insidehighered.com/new/2006/08/14/sierra

"The End for a Private College" in Chronicle of Higher Education:

http://chronicle.com/weekly/v53/i06/06a03301.htm

And where is Dr. James L. Ash, Jr., the authority on Religious Studies and former President of Whittier College, now?

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

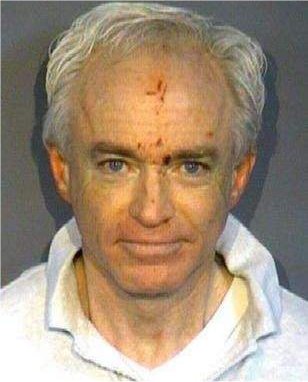

James L. Ash, Jr.: Before and After

Before

The Illusion :http://www.sargentportraits.com/professionals/ash2.htm

After

:

NEW: The following article

provides details of James Lee Ash, Jr.'s outing and mental health, drug, financial

and legal problems, but its author, like most Jim Ash apologists, puts the cart

before the horse, tries to blame a drug for a man's wrongdoing. Dr. James Lee

Ash, Jr.'s overriding issue is that he's gay and lived a lie for many years.

Ash's case is strikingly similar to that of Rev. Ted Haggard, except that Haggard

went to adult male prostitutes, while Jim Ash is attracted to teenagers. Like

Haggard, Ash found that methamphetamine propelled him beyond his fear of his

gay sexuality exposing his only apparently model life as a hoax, perpetrated

on his wife, his children, peers, on students, on thousands of unsuspecting

people he involved in that hoax, but at the cost of his own ability to control

himself and events.

Whittier College doing nothing to clarify Ash's interactions with students at

the College, and with young males at the Hollywood parties where, according

to court records, Ash was doing the same things, while President of Whittier

College, that he later did in Nevada, that he was imprisoned for there, may

suggest Ash's predatory behaviors had already been made known to the College.

Has O J Simpson ever looked for those he suggests murdered Nicola Simpson Brown

and Ronald Goldman? If Whittier College had been taken by surprise by Jim Ash's

Nevada arrests, one would think the first order of business would be to ascertain

whether or not there are Whittier College student and/or other young Los Angeles

area Ash victims. Sierra Nevada College was surprised, and no longer exists.

Is that Dr. James Lee Ash, Jr.'s fault, or Ash's and Whittier College's fault?

The following article: The rise and fall of a Nevada

meth addict", by Jaclyn O'Malley for the Reno Journal-Gazette,

includes Jim Ash mug shot.

http://news.rgj.com/apps/pbcs.dll/article?AID=/20060625/NEWS01/101100028/0/NEWS&theme=METH

Jim Ash might do well to devote any lucid moment to

reading Crystal Meth And Men Who Have Sex With Men, edited by M. D.'s Milton

L. Wainberg, Andrew J. Kolodny and Jack Drescher. Reviewer Jim McDonough writes

that, "According to recent studies, gay men who use crystal methamphetamine

were twice as likely to have unprotected sex as those who did not - and more

than three times as likely to be HIV-positive." And that "..."Tina"

users...are lost in a downward spiral of addiction and high-risk sexual behaviors."

McDonough claims this problem is an "emerging health crisis." We don't

know about that, but we do note that when Jim Ash has been arrested, in the

detailed lists of what were in his possession at those times, which drugs (marijuana,

crystal meth), paraphernalia (hypodermic needles), and sex-related items (lubricant

and gay pornography), no item that would make protected sex possible is reported

to appear.

Jim Ash could've saved himself and his victims all that has happened by simply

being honest, with himself, and with others, but then he'd never have been selected

as Whittier College President by Trustees who themselves need some Trustees.

At least we know why there hasn't been a male president of Whittier College

since Dr. James L. Ash, Jr., can see that the Trustees of Whittier College appear

to be paranoid, which is a condition requiring treatment. A mass resignation

of the Trustees of Whittier College and the replacement of the current administration

under the supervision of new Trustees would give the Whittier College a chance

to remake itself, free of its troubled past and current irrationality.

The mystery of Jim Ash's energy that so impressed Whittier College and then Sierra Nevada College has been solved - as has why Ash resigned the presidency of Whittier College. The only remaining mystery is why Whittier College failed to protect students from their own president's predations and, even after learning the truth about James Lee Ash, Jr., failed to help his southern California victims and allowed him to victimize more young people and ruin another state's only private small liberal arts college.

Hanno Soth apparently never started classes

at Whittier Law, but Whittier Law accepted two deposits (for Fall ' 90) from

Soth, the second deposit sent by FedEx on July 5, 1990, just one day after the

elderly Carmen Herbert died in Hawaii. Soth, also on July 5, 1990, filed a petition

to probate Carmen Herbert's 1989 will. During this period, Soth was an illegal

tourist visa overstay in the United States, yet Whittier Law took Soth's payments

for courses to commence in a matter of weeks.

In 1973, Carmen Corrine Herbert made a will, leaving one-half her money to her

church and one-half to the Shriner's Hospital for Crippled Children. In late

December of 1989, by which time Carmen Herbert had begun suffering from the

onset of dementia and was under Soth's exclusive care, he engineered a new Herbert

will, from which it's estimated Soth would have personally received in excess

of $1.5 million.

Carroll Taylor, attorney for the prevailing party, First Church of Christ, Scientist

in Honolulu, in protracted litigation over Herbert's wills, suggested the worst

case scenario: "Soth had the means (a 26 year old man could easily overpower

a sleeping 84 year old woman), the opportunity (he spent the night of July 3,

1990, in her house alone with her, the only time he had done that), and the

motive (he had already accepted an offer to attend Whittier College of Law in

the fall of 1990 and he stood to inherit $1.5 million plus)." An attorney

for Soth, Michael McGuigan, claimed there was no, and the Honolulu police did

not find, "evidence of any foul play..."

On September 11, 1990, Soth was noticed that he was subject to deportation as

an illegal overstay in the United States (since his tourist visa had expired

in June of 1988). The next day, Soth filed an application to be appointed special

administrator for Carmen Herbert's estate, misrepresenting that he was a resident

of Hawaii, an administrator requirement. On November 5, 1990, Soth's deportation

was stayed on condition that he voluntarily departs from the United States at

his own expense no later than December 5, 1990.

A trial court jury denied probate of the 1989 will, "...on the bases that

Carmen lacked the requisite testamentary capacity for its execution, was mistaken

about its contents, and was unduly influenced in its execution." Soth appealed,

contesting among other things the trial court's admission of evidence related

to Whittier Law, including Soth's request that Whittier defer his admittance

for one term, citing his special administrator responsibilities. The Supreme

Court of Hawaii ultimately affirmed the trial court verdict that the 1989 will

be held invalid.

Hanno Soth did not go to Whittier Law - because he couldn't afford to do so.

The only way Soth could've carried out his plan to attend Whittier Law was if

Carmen Herbert died quickly enough and the 1989 will making Soth Herbert's primary

beneficiary was probated quickly enough. While Carmen Herbert's death occurred

quickly enough for Soth's purpose, the 1989 will was invalidated by a jury and

their judgment was affirmed by Hawaiian Appeal as well as Supreme Courts.

Hanno Soth has resurfaced in Bali. Thomas Henderson, who let Soth live rent-free

in an Oahu room and knew his financial situation and activities, told the Honolulu

Star-Bulletin that Soth moved to Indonesia where he posed as a major real estate

developer. "[Soth] just tries to tie things up with minimal investment.

He's what I would call very shrewd."

Soth issued a press release on the internet stating that the Star-Bulletin article

in which Henderson is quoted defamed Soth as it spread through Indonesia, which

"is clearly damaging for PT. Hanno Bali," Soth's fantastic south seas

development company proposing to cater to who else but the rich. In April 2005,

Soth claimed that the Bali police were investigating Henderson and Star-Bulletin

journalist Ian Y. Lind for defamation. More than a year later, Lind commented

that "I've had no contact from either Hanno Soth or the Bali police since

this complaint was supposedly filed."

Soth's scheme to turn vacant coral atolls in Indonesian waters into luxury resorts,

similar to atolls being permanently evacuated due to sea level rise, took an

even more fantastic turn when Soth announced a partnership with A4M, a so-called

anti-aging business initiated by two osteopaths, Robert Goldman and Ronald Klatz,

to turn the proposed luxury resorts into luxury anti-aging resorts.

In 2000, the State of Illinois ordered Goldman and Klatz to stop identifying

themselves as MD's. Some years later, Goldman and Klatz were issued limited

medical practice licenses. They cannot, for example, write prescriptions. "There

is no such thing as anti-aging medicine," says University of Illinois sociologist

Jay Olshansky, who specializes in medicine and longevity. A4M filed a $120 million

defamation suit against Olshansky, who filed a counter suit. The suits were

subsequently dropped. Unfortunately, even the Fountain of Youth is too late

for Carmen Herbert.

'Test of Wills' by Ian Y. Lind:http://starbulletin.com/2000/10/10/news/story4.html

In the Matter of the Estate of Carmen Corrine Herbert, Deceased: http://www.hawaii.gov/jud/16291(1st).htm

It's a fantasy, alright...

'Private Islands of the Rich and Famous': http://www.prweb.com/releases/2004/4/prweb116831.htm

But it gets even more fantastic...

'The Rich Get Richer..and now the Rich get younger too..Is it fair?:

http://www.hannobali.com/news_&_press/onelifeplus_antiaging.html

Whittier Law, through no fault of its own, missed out on a real wunderkind, and God only knows what else, in Hanno Soth.

Steve Unger was graduated by Whittier

Law and began practicing law in California, first with and then without standing

with the California State Bar Association. After a series of misconduct findings

and discipline therefore, Unger was suspended by and then compelled to resign

from the State Bar.

Finally, Unger, and his junior partner in crime, Bryan Kamenetz, were arrested

and charged with conspiracy to violate the practice of law by non-lawyers, theft

from an elder or dependent adult, grand theft of personal property, forgery,

NSF check issuance, and grand theft by embezzlement, among the 18 count criminal

complaint's charges.

Unger's first suspended State Bar suspension/probation condition was that he

take and pass the Professional Responsibilities Examination. When Unger resigned

from the State Bar, he did so without ever having taken and passed the MPRE.

Specific misconduct during the period when Unger was licensed to practice law

ranged from the exotic, fabricating court orders, to the mundane, stealing from

his clients.

Search Supreme Court Minutes, October 3, 2000 Unger and then Supreme Court Minutes, March 18, 2002 Unger at http://www.courtinfo.ca.gov/cgi-bin/search.cgi for Steven Howard Unger Disciplinary Action and Resignation, respectively.

http://www.metnews.com/articles/2005/badx091505.htm

Nicola Jagessar

See Conspiracy page on this site.